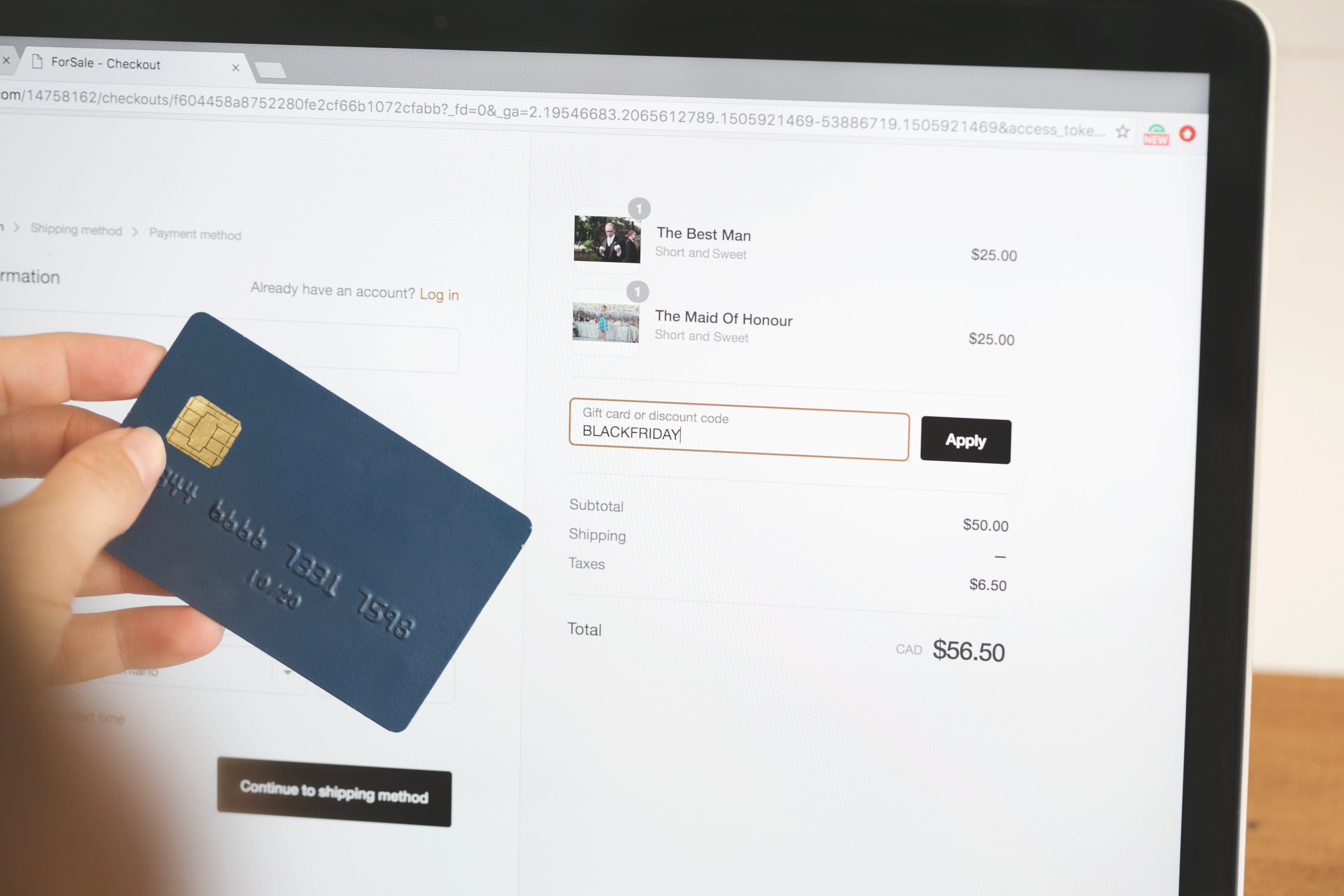

Real-time online payment processing offers rapid and protected methods for merchants to be paid for their goods or services. The very nearly immediate practices present some safety from fraudulent buys as confirmation is important prior to the deal is completed.

Online payment processing, benefits, not only the retailers, who get almost immediate payment for items or services that they provide, however it gives the customers the ease of making immediate payments. Possibly typically the most popular moderate for transferring the obligations, is with the use of charge cards, and without a way of accepting bank card obligations, the merchant may be doomed failure.

One of the greatest advantages of online payment processing comes from the capability to keep track of the various kinds of payments. With a reliable merchant bill, you can easily gain access to functions such as for instance automatic payments and recurring billing, which can all be used to boost the profitability of your organization, as consumers can develop to comprehend the convenience.

Even though you will need Global Payments Running in order to take orders from everywhere on earth, global obligations are now really localized. Suppliers promote internationally, consumers pay locally. Giving the proper local payment option may fast accelerate sales. Ignoring regional funds options may press income and possibly drive you out of company in a particular territory.

Payment infrastructure and regional cultures vary. Customers have chosen ways of payments. Retailers that offer localized obligations can capture more revenue and help build long-term trusting associations with buyers.

Global payment processing tastes vary. In the United Claims, net consumers choose to pay by credit cards. In Europe, bank moves are commonly used. In Ch ina, Asian charge cards and bank transfers are preferred. Around the world, portable obligations are employed for micropayments of electronic material and on line entertainment.

ina, Asian charge cards and bank transfers are preferred. Around the world, portable obligations are employed for micropayments of electronic material and on line entertainment.

Certain payment types may possibly require the establishment of a nearby bank connection and establishment of a corporate existence in the area country. As an example, establishment of a primary business reports need a connection with an getting bank in the jurisdiction. Banking associations in some places must certanly be facilitated through the release by a trusted payment partner. Consider your collection carefully. The financial institution you choose may also have an effect on the processors and Payment Facilitation Providers you are able to support.

Card discount fees, bank moves and strong debit expenses vary by country. Whether it is needed, organizations often find it good for establish a local presence to make the most of lower payment processing rates. Web getting patters change by state and payment type and certain parts have higher incidences of fraudulent transactions. The process is always to stability the utmost number of income with the lowest possible risk.

It is essential to make use of fraud recognition resources, fitters, rules, testing and velocity checks to regulate fraud around possible. Card authentication resources may possibly or may not be accessible, depending upon country. Handle confirmation programs and public report searches are limited outside the United Claims, Europe and some parts of the the EU.

Online payment processing has become at the heart of ecommerce, as it offers customers the convenience of a quick and secure strategy to pay for buys with a debit or credit card. It also assists vendors by effortlessly handling a sizable level of transactions. The method may look fast, but it really involves numerous various transactions.

The payment processor can request confirmation of the validity of the card, from the financial institution that issued the card. When evidence has been confirmed, the important points are then provided for the business through the payment gateway. The business is then obligated to perform the process. If proof is rejected, the vendor can also be educated, where in actuality the exchange will soon be denied. Since payments are processed at a faster charge, the business may are in possession of a much improved money movement, with which she can manage her business.